Canada's 2017 Innovation Budget Released

The 2017 Federal Budget Plan was released yesterday and in terms of innovation significant changes appear to be on the horizon.

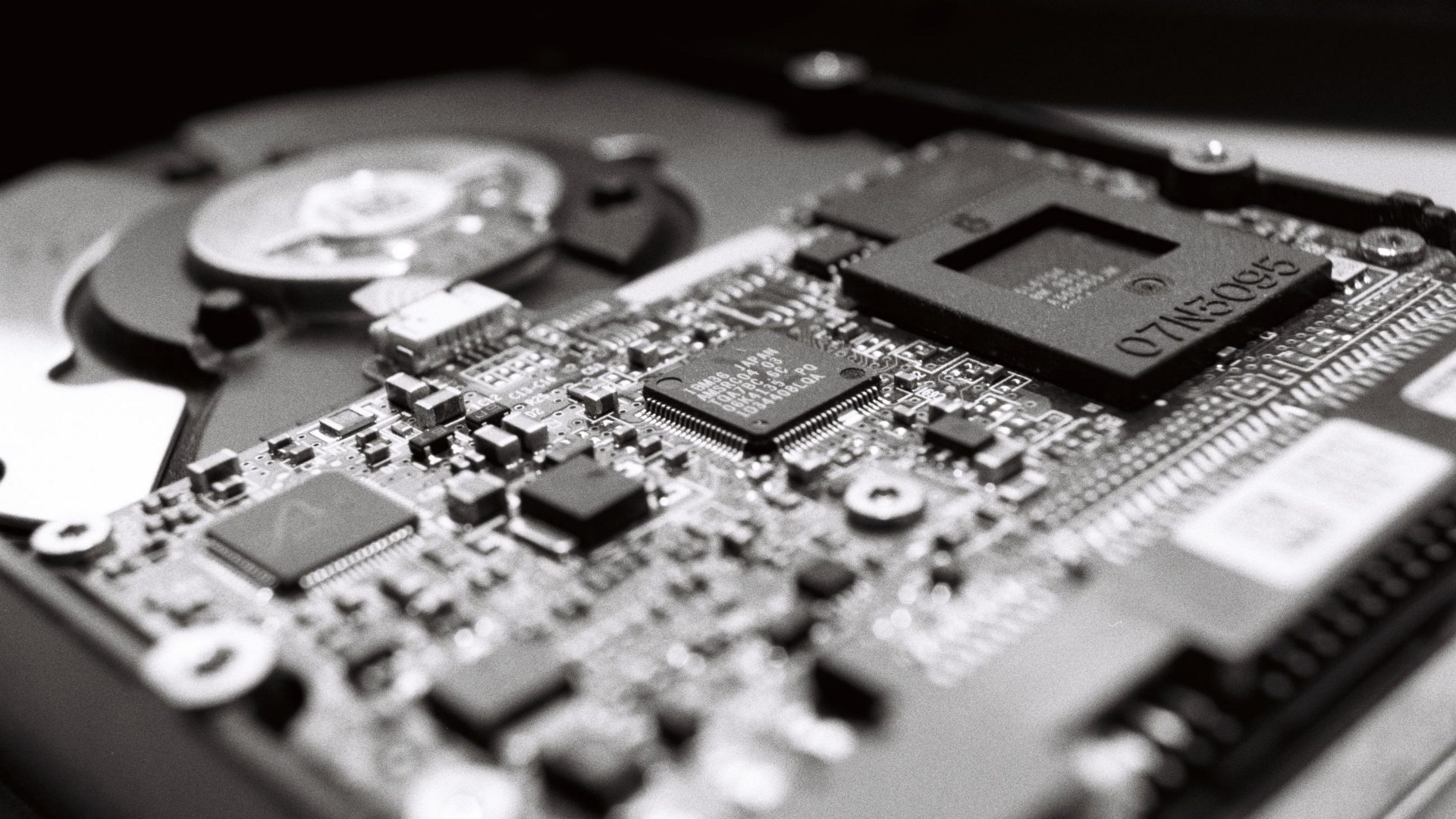

Human-Machine Interaction (HMI)

Human-Machine Interaction (HMI) is the study of interactions between humans and machines...

Government Funding Opportunities for R&D

According to a study, Canadian start-ups do not take advantage of government funding opportunities.

SR&ED Contracts

SR&ED can be claimed by you for work performed in-house. It can also be claimed for work performed, in Canada, on your behalf by an arm’s length 3rd party.

SR&ED Filing Deadline

First time SR&ED claimants are not always cognizant of the fact that if you miss a SR&ED filing deadline you lose the tax credits.

CRAs Revised Guidelines for resolving claimant SR&ED concerns

If you are not satisfied with the proposed outcome of your SR&ED claim you have the option...

Canada's Innovation Budget

The Liberals want to spend their way out of Canada's current economic doldrums, similar to the position taken by the US following the Great Recession.

Convincing the Research & Technology Advisor (RTA)

If you are unfamiliar with the idiosyncrasies of Canadian tax law you will probably be surprised to learn that in a dispute with Canada Revenue Agency (CRA) the initial onus of proof is on the taxpayer.

Department of Finance Canada's proposed SR&ED legislative changes released

This month the Department of Finance Canada issued multiple proposed...

US R&D Tax Credit Positive Changes

The US Research & Experimentation Tax Credit, R&D Tax Credit, was a temporary measure ...

SR&ED Audits - Supporting Documentation

One of the most important criteria of a SR&ED claim is supporting documentation, i.e. tangible evidence. This is the case even though the legislation does not mandate such documentation and the case law gives considerable authority to oral evidence. We understand why the CRA requires some documentary evidence to support an SR&ED claim, however there sometimes is a divergence between what CRA and the Tax Court of Canada considers sufficient.

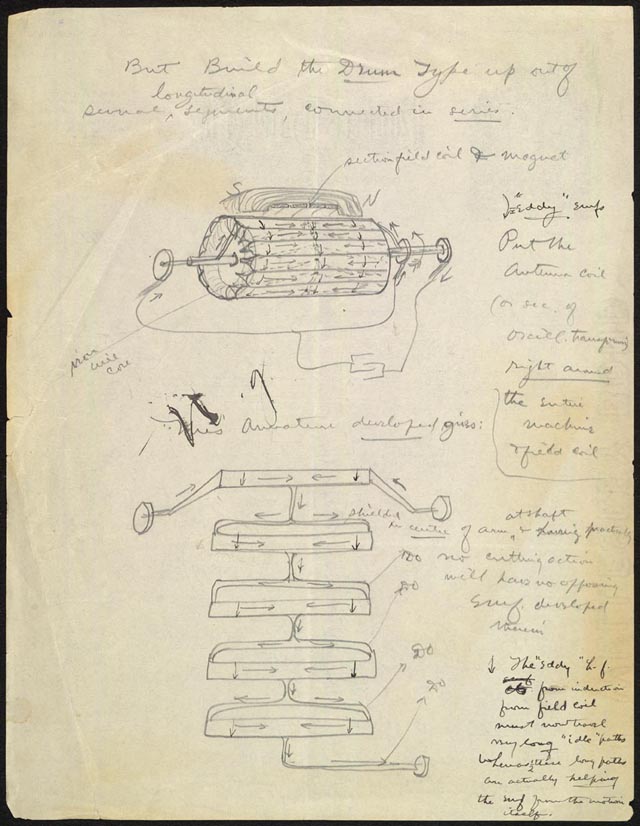

SR&ED Audits - Project Deconstruction

The first installment of our CrossDynamix blog discusses the topic of "project deconstruction" during a SR&ED audit. The CRA's Research and Technology Advisor ("RTA") often asserts that the project is claimed at too high a level and that it is necessary to drill down to lower-level and more detailed activities; assessing individual activities (or individual sentences) as though they needed to embody an entire SR&ED claim on their own. The suggested response to the RTA in these scenarios is that it is important that the SR&ED be viewed at the correct level and that there are plenty of established guidelines about the issue of breaking things down too finely.